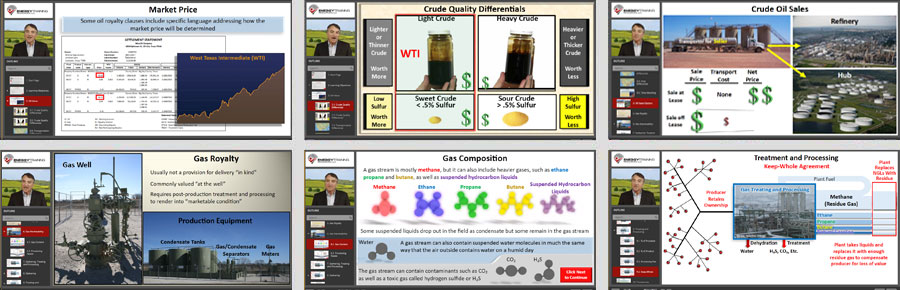

The first part of this module explains oil royalties and the different details that go into an oil royalty such as: taking in kind, determining market price, and the quality and location differentials to benchmark prices. The next part describes gas royalties and everything that goes into calculating it, such as: valuing gas at "the well," common "post production" requirements to market gas, gathering and compression, treatment and processing (including types of processing contracts), and deductions for post-production costs. It then covers the deductions for production taxes. Lastly, this module explains royalty statements.

Duration: Approximately 24 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Describe how royalty owners could be paid oil royalties in cash or in “kind”

- Explain how royalty oil is valued and how royalty prices can be compared to benchmark prices

- Name post-production costs often required to market gas and how those costs affect the value of gas “at the well”

- Summarize the debate about the deduction of post-production costs from gas royalties

Prerequisites: Module 1-7

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.