US Mineral Rights and Leasing

This course has highly-useful information for anyone involved with the oil and gas industry. You don’t need to know anything in advance, but when you finish, you will have comprehensive knowledge of US minerals ownership as well as the leasing process that oil and gas companies use to acquire minerals rights. You will also be informed on up-to- date topics such as evolving horizontal well regulations, forced pooling, post-production costs, surface use agreements, and the contentious relationship between the industry and the federal government.

The course takes you through the interesting historical process that created a mosaic of private and governmental mineral estate ownership in the US – as well as the rights of a mineral estate with respect to oil and gas and how those rights are regulated. It describes how a mineral estate can be carved up into various types of interests, how those interests can be jointly owned and how properties can be pooled together into larger work areas. It discusses all of the major leasing provisions, why they are used, and how they affect the parties to a lease. Conveyances and title issues are also discussed as well as the roles of land professionals. The course also includes sections on federal onshore and offshore leasing that should be of interest to every American.

The course is narrated throughout and is rich with photos, graphics, and animations. Learners can optionally drill down on some topics to learn more and can test their knowledge at the end of each section with our interactive quizzes. The course is broken down into convenient-sized modules and the entire course is approximately 10 hours long, depending on your pace.

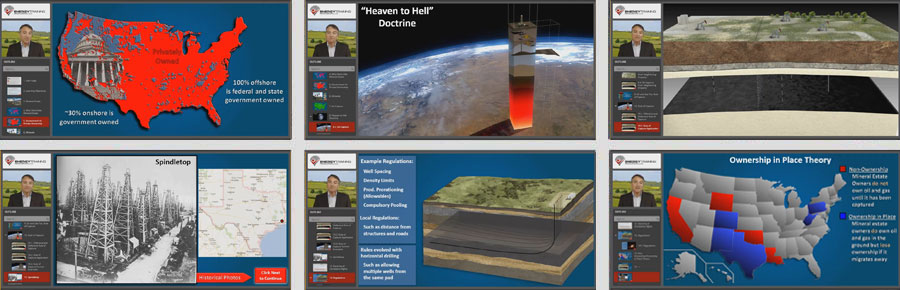

This module explains private ownership of minerals, the Rule of Capture and the issues with the Rule of Capture, it describes what the Doctrine of Correlative Rights is, the importance of conservation laws and ownership theories.

Duration: Approximately 25 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Explain why it is unique that the majority of onshore mineral rights are privately-owned in the United States

- Discuss why usual rules of mineral ownership do not apply well to oil and gas

- Describe the Rule of Capture, which establishes ownership of oil and gas production

- Name problems that can result from the Rule of Capture

- List reasons why conservation laws have been imposed by states

Prerequisites: None

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

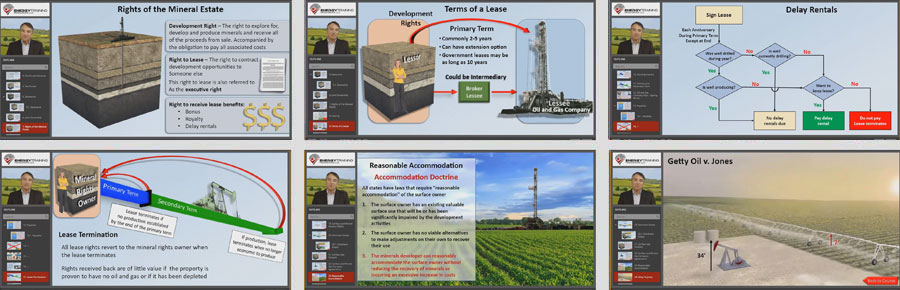

This module describes what it means to have a Fee Simple Absolute mineral estate, how mineral estates are severed, and the rights of the mineral estate. It also gives an overview of leasing rights, explains how the mineral estate is the dominant estate, having implied use of the surface, through the use of the Accommodation Doctrine.

Duration: Approximately 30 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Explain how the mineral estate can be separated from the surface estate

- Name the basic rights of the mineral estate owner

- Describe why leasing is common

- List the basic terms of a lease

- Explain when and how a lease terminates

Prerequisites: Module 1

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

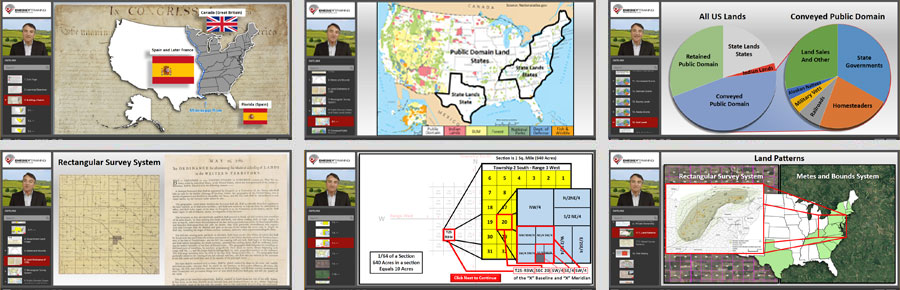

This module shows the how the nation's land was originally divided. Next, this module covers the difference between "Federal land" states and "state lands" states. The US was divided using two different methods of measurement, the metes and bounds survey method and the rectangular survey system, and this module explains the differences between those. The distribution of federal lands is described, showing how land was conveyed to homesteaders, military vets, natives, railroads, state governments or sold and how the patents were granted. The way these lands were divided and distributed has large implications for oil and gas and this module explains why that is.

Duration: Approximately 50 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Describe how US territory was acquired over time and that most, but not all, was initially owned by the US government

- Explain how US government land was surveyed into townships and sections using the Rectangular Survey System

- List reasons why most of the US government land passed into state or private ownership over time

- Summarize the current status of US government land holdings

- Compare differences between government and private ownership

Prerequisites: Module 1-2

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

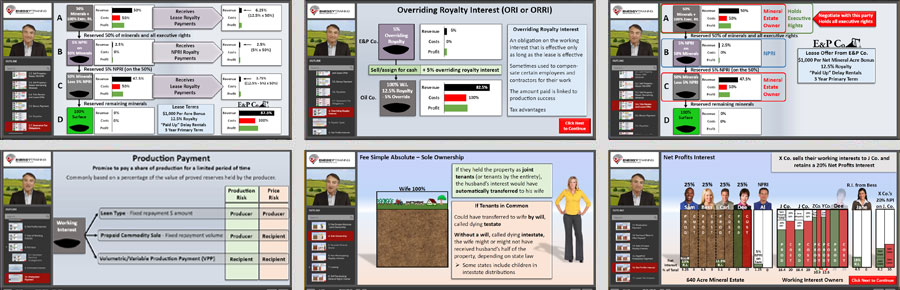

This module explains why mineral estates may have a large number of joint owners. There are different ways a mineral estate can be divided when owned by multiple parties, so, this module breaks down each way into easy to understand descriptions. It describes how undivided mineral estates work. How concurrent joint ownership is implemented and its three types: tenancy in common, joint tenancy, and tenancy by the entirety. It also covers successive joint ownership, including life estates and others.

Duration: Approximately 25 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Define undivided joint ownership

- Explain why mineral estates are often jointly owned

- Name types of joint ownership

- Identify key differences in joint ownership types

- Explain current versus successive joint ownership

- Discuss joint ownership implications on leasing

Prerequisites: Module 1-3

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

Not all minerals are included in severed estates. This module explains what types of minerals can be included. What is considered surface substances vs. minerals? It covers the breakdown of where the surface stops and the minerals begin. Also, this explains that when a mineral estate is severed and sold, part of the mineral interest can be withheld. This small portion is called a non-participating royalty interest (NPRI). There is an explanation of executive rights after a severance, who makes the decisions and why. This module touches on the issues of adverse possession and the rights those claims have. Finally, it describes what kind of restrictions on development rights one may come across.

Duration: Approximately 20 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Name the minerals are typically included in an oil and gas lease

- Explain how a mineral interest can be severed vertically or horizontally

- List the attributes of a non-participating royalty interest

- Describe how executive rights to lease can be assigned to one owner on a jointly-owned property

- Discuss how a property can be acquired by adverse possession

- Name types of restrictions that can be placed on the use of property

Prerequisites: Module 1-4

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

This module provides examples of conveyances and subdivisions of a mineral estate over time. It describes joint working interests and joint operating agreements which govern the partnering of oil and gas companies. It explains overriding royalty interest. It also compares different royalty types: NPRI, lease royalty, and overriding royalty. Furthermore, this module explains net profits interest, farmouts, and production payments.

Duration: Approximately 38 minutes, depending on user pace. In two modules: 6A (20 minutes) and 6B (18 minutes).

Learning Objectives: Upon successful completion of this module, you will be able to:

- Name all of the common types of mineral interests

- Explain the origination and purpose of mineral interest types

- Describe common methods and reasons for mineral interest conveyances

- Discuss the relationships between mineral estate owners and working interest owners

- Discuss how a mineral estate owner could participate as a self-developer

Prerequisites: Module 1-5

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

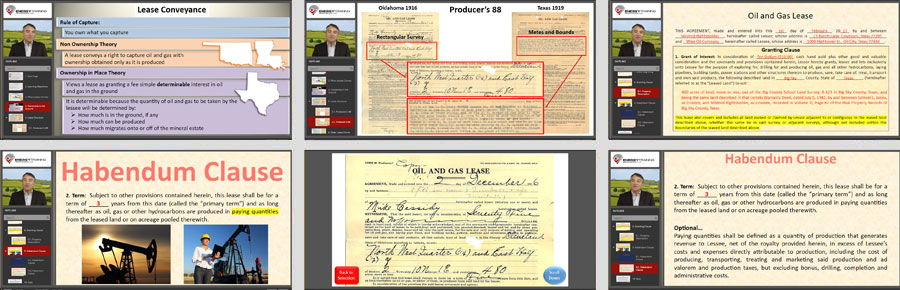

This module gives a background of leasing. It explains where the term "Producer's 88" came from and why it is important to oil and gas leases. It goes over what a lease conveys and explains how a lease identifies the parties and the effective date. The lease is further explored with the granting section, which includes: consideration, words of grant, minerals and developments rights included, the property description, and the Mother Hubbard clause. It wraps-up with relating what the Habendum clause in an oil and gas lease is, including descriptions of the primary term, the secondary term, and paying quantities.

Duration: Approximately 24 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Recount the evolution of leasing forms and the common use of the term “Producer’s 88”

- List the key elements included in a granting clause

- Describe the Habendum clause and differentiate between the primary term and secondary terms of a lease

- Identify the duration of a lease under different scenarios

- Explain why a producing lease will expire if production falls below an economic level

Prerequisites: Module 1-6

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

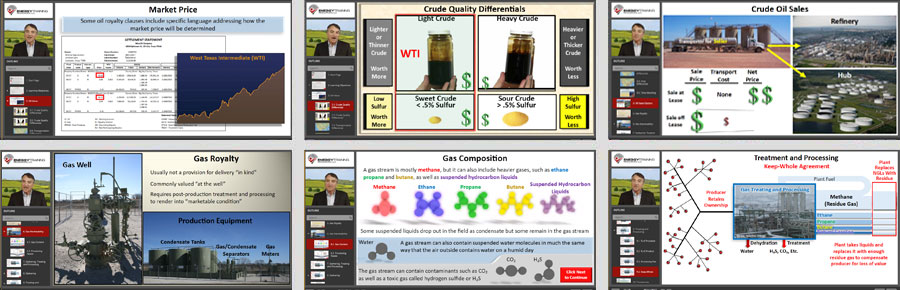

The first part of this module explains oil royalties and the different details that go into an oil royalty such as: taking in kind, determining market price, and the quality and location differentials to benchmark prices. The next part describes gas royalties and everything that goes into calculating it, such as: valuing gas at "the well," common "post production" requirements to market gas, gathering and compression, treatment and processing (including types of processing contracts), and deductions for post-production costs. It then covers the deductions for production taxes. Lastly, this module explains royalty statements.

Duration: Approximately 24 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Describe how royalty owners could be paid oil royalties in cash or in “kind”

- Explain how royalty oil is valued and how royalty prices can be compared to benchmark prices

- Name post-production costs often required to market gas and how those costs affect the value of gas “at the well”

- Summarize the debate about the deduction of post-production costs from gas royalties

Prerequisites: Module 1-7

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

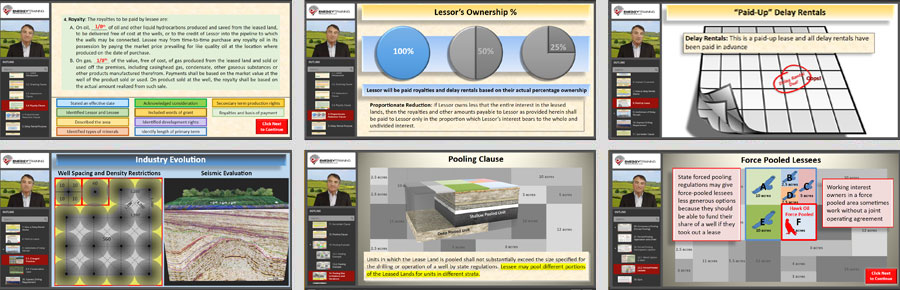

This module explains the proportionate reduction clause which is important to know to understand that the Lessor's royalty payment amount. Also, in this module, is the delay rental clause: why it is used, the implied covenants to perform work, when delay rental payments are paid, and paid-up leases. Next is the surrender clause, explaining how the Lessee can surrender their portion and be relieved of obligations. This module goes in-depth into the pooling clause including: when and why it is needed, the drilling/spacing requirements, a pooling example, the calculation of net revenue interests in a pooled unit, the complications caused by the presence of a NPRI, partially-leased tracts, compulsory/forced pooling and the common compulsory-pooling participation options.

Duration: Approximately 35 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Describe why delay rentals are used and how they are paid

- Retell why most private-party leases today have “paid up” delay rentals

- Summarize why pooling is necessary for small tracts

- Calculate the net revenue interest for participants in a pooled unit

- Explain the basic purpose and procedures for forced pooling

Prerequisites: Module 1-8

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

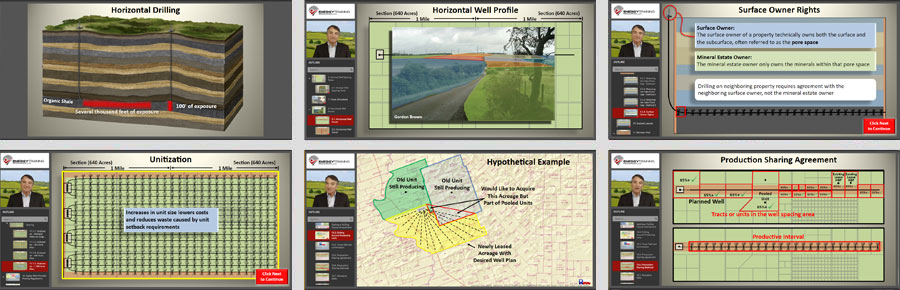

To start, this module gives a geological overview of unconventional formations and based on this, an explanation of why and how horizontal wells are drilled. Next, is an example based on Texas's state regulations, including: conventional spacing and density rules, horizontal accommodations implemented with Rule 86, take-point gap and off-lease spudding, and stacked laterals. Following that example, it moves to the Colorado DJ basin with an example of forced pooling and the rectangular survey system, followed by an example in the North Dakota Bakken area. Within this module there is an optional drill-down section that details Texas rules, including: the difficulties of working without forced pooling, production sharing agreements, and allocation wells.

Duration: Approximately 35 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Name common types of state-imposed spacing and density rules that apply to vertical oil and gas wells

- Explain why horizontal wells are required in unconventional formations and why those wells need different spacing rules than vertical wells

- Describe how states that use the Rectangular Survey System and have forced pooling tend to have more-efficient unconventional development

- Draw examples of how horizontal well groups have been drilled in some key unconventional development areas

Prerequisites: Module 1-9

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

Starting off, this module covers the vertical and horizontal Pugh clauses and the retained acreage clause. Next it goes into detail about the savings clauses, including: the dry hole clause, the shut-in gas royalty clause, the continuous operations clause, the cessation of production clause, and the force majeure clause. It describes the warranty clause, subrogation clause, equipment removal clause, and the assignment clause. This module also examines surface use provisions and restrictions along with surface use agreements. Then, it explains the issues caused by variations in lease terms that are in the same tract or unit. Lastly, it covers community leases, seismic agreements with lease options, lease extension options, and top leasing.

Duration: Approximately 25 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Explain vertical and horizontal Pugh clauses

- List the “savings clauses” that can be used to ensure that a lease does not terminate prematurely

- Describe the Warranty, Subrogation, Equipment-Removal and Assignment clauses

- Discuss surface-use agreements and their purpose

- Summarize issues that can arise from having several leases with different terms in the same tract or unit

Prerequisites: Module 1-10

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

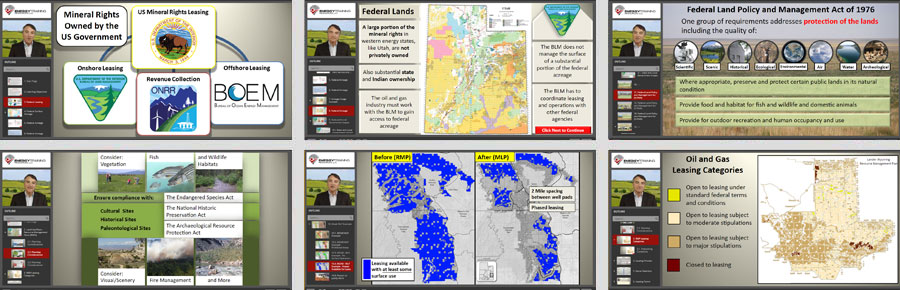

This gives an overview of federal onshore acreage and list agencies that manage the surface of federal acreage. It explains the role of the Bureau of Land Management, which manages onshore mineral rights. It continues with showing how the BLM coordinated with other federal agencies that manage surface acreage. Next, this module describes the types of acreage that is generally closed to leasing. There are federal mandates that prescribe land protection and use (FLPMA and MLA) and Resource Management Plans. It continues with explaining the leasing process. Then shows how BLM's changed interpretations of federal mandates have negatively impacted oil and gas. It delves into the new advent of the restrictive Master Leasing Plans and gives an example this using the Moab Master Leasing Plan.

Duration: Approximately 53 minutes, depending on user pace. In two modules: 12A (25 minutes) and 12B (28 minutes).

Learning Objectives: Upon successful completion of this module, you will be able to:

- Explain the role of the Bureau of Land Management (BLM) in leasing federal mineral rights

- List other federal agencies that manage federal surface acreage and how their guidelines and objectives may conflict with and/or disallow leasing

- Summarize the federal mandates that the BLM is required to follow in its leasing decisions and how the BLM’s interpretation of those mandates became more restrictive during 2009-201

- Describe Resource Management Plans and the more-restrictive Master Leasing Plans that have been used more-recently by the BLM

- Outline the federal onshore leasing process

Prerequisites: Module 1-11

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

It begins with defining the territorial waters and the Exclusive Economic Zone and continues with explaining the differences of state and federal waters. It describes what the federal Outer Continental Shelf (OCS) is and the areas of the OCS that are closed to leasing (the majority). Next this module explains the Five-Year Leasing Programs. It continues by providing detail about the western and central Gulf of Mexico, including: the development to date, exploration and development's movement into deeper water, subsea completions and floating platforms. We then move north to the Alaskan Outer Continental Shelf and see the cancelled sales of the past, the story of the Chukchi Sea and Beaufort areas, and finally take a look at the Cook Inlet. Lastly, it explains the offshore leasing process and about leasing in state waters.

Duration: Approximately 27 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Describe offshore territories where the federal government and states own mineral rights

- Point out the offshore areas where most development has taken place

- Relate how most US offshore areas are not available for leasing

- Discuss the 5-Year Leasing Programs and the leasing process

- Explain how available shallow-water areas have been extensively developed so activity continues to move into deeper waters

Prerequisites: Module 1-12

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

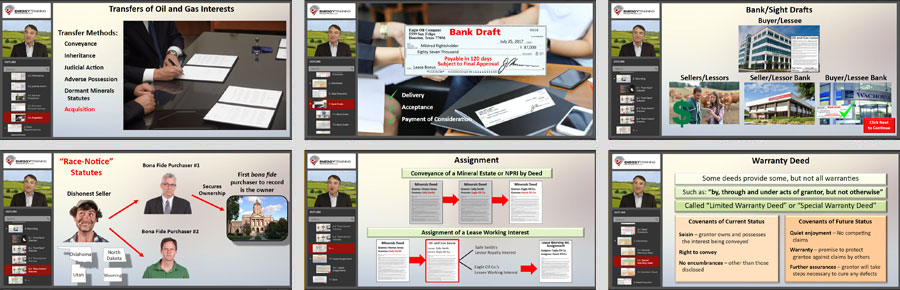

This module begins with an overview of transfer types and methods. It continues with conveyances, including: Required elements and common provisions, minerals vs. royalty conveyances, warranty deeds and quitclaim deeds, delivery and acceptance, and the use of bank/sight drafts. It follows up with explaining recording and recording statues. Then, it wraps up with a description of assignment of lease-related interests.

Duration: Approximately 30 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Describe ways that mineral rights can be transferred

- List required elements of a conveyance

- Explain the common use of bank drafts to make conditional payment

- Name the three different types of recording statutes used by states

- Describe lease assignments

Prerequisites: Module 1-13

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

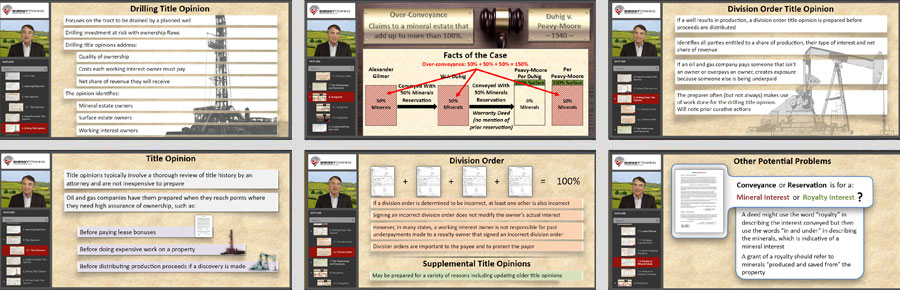

This module examines the purpose and scope of a title opinion, the lease purchase title opinion, the drilling title opinion, and the division order title opinion and division orders. It then gives examples of title defects and title exposures. Next this module explains the Duhig Rule, its origin and purpose. Finally, it finishes with curative work, curative instruments, and curative statutes.

Duration: Approximately 35 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Explain the purpose of title opinions

- List types of title opinions

- Describe a division order

- Name some common title defects

- Discuss curative actions that can be taken to cure title defects

Prerequisites: Module 1-14

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

This final module moves into explaining who landmen are and their duties along with The American Association of Professional Landmen (AAPL). It describes the roles of attorneys and Lease and Title Analysts, and their duties, along with The National Association of Lease and Title Analysts (NALTA). Finally, it includes an overview of Division Order Analysts and their duties, along with The National Association of Division Order Analysts (NADOA).

Duration: Approximately 30 minutes, depending on user pace.

Learning Objectives: Upon successful completion of this module, you will be able to:

- Describe landmen and list some of their duties

- Summarize the title examination process

- Name other key land-related roles

- Name organizations that support land professionals and some of the professional certifications that they issue

Prerequisites: Module 1-15

Advance Preparation: None

Program Level: Non-technical

Format: Prerecorded narrator with supporting visuals. User controls course pace.

At the end of this course, users may complete an exam to test their understanding and retention of the course information.